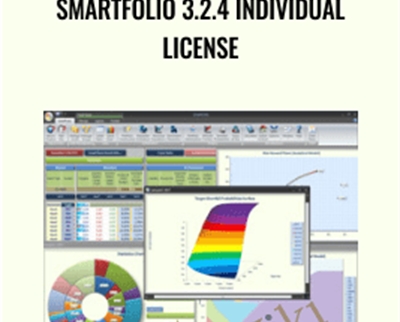

SmartFolio 3.2.4 Individual License – SmartFolio

Giá gốc là: $599.00.$39.00Giá hiện tại là: $39.00.

SmartFolio 3.2.4 Individual License – SmartFolio Download. Our portfolio analysis software, SmartFolio, is a highly advanced, easy to use analytical tool t…

🎓 Learn and Grow with SmartFolio 3.2.4 Individual License – SmartFolio - Giá gốc là: $599.00.$39.00Giá hiện tại là: $39.00.

Unlock your potential with the SmartFolio 3.2.4 Individual License – SmartFolio - Giá gốc là: $599.00.$39.00Giá hiện tại là: $39.00. course. Designed for learners of all levels, this comprehensive online program offers you the tools and strategies to achieve success in both your personal and professional life. At WSOLib, we provide top-quality learning resources, making it easy for you to enhance your skills from the comfort of your own home.

Whether you're looking to advance your career, improve your knowledge, or explore a new hobby, the SmartFolio 3.2.4 Individual License – SmartFolio - Giá gốc là: $599.00.$39.00Giá hiện tại là: $39.00. course is your gateway to valuable insights and practical applications. Start your learning journey today and experience the benefits of lifelong education!

Salepage link: At HERE. Archive: http://archive.is/Q0fsl

Our portfolio analysis software, SmartFolio, is a highly advanced, easy to use analytical tool to assist and enhance the management of investment portfolios according to the investor’s risk profile.

SmartFolio is a state-of-the-art asset allocation software aimed at all types of investors and investment professionals. Active SmartFolio users include institutional portfolio managers, investment advisors and sophisticated private investors. SmartFolio contains advanced asset allocation, portfolio optimization and risk management techniques, based on the most recent achievements in portfolio theory .

The software combines highly advanced and innovative analytics with a user-friendly, intuitive interface, perfectly suited to any level of expertise and experience.

Commercial sales of SmartFolio are currently frozen

Sales of SmartFolio to commercial users were frozen on March 1, 2014. This is due to the company partners’ focus switching to portfolio management and arising conflict of interest that had to be resolved.

Existing SmartFolio clients aren’t affected: they will be able to roll their annual licenses and get support as before. If you’d like to roll your license please contact us directly.

Non-commercial users (university professors and researchers) continue getting access to SmartFolio without any limitations both for themselves and their students, with limited support. If you are a student and you’d like to use SmartFolio in your project, please ask your tutor to contact us.

Current SmartFolio release: 3.2.4 – December 5, 2013

What’s new in SmartFolio:

- Risk Parity portfolios

- Maximum Diversification portfolios estimates

- Expanding in-sample window in walk-forward optimization

- Free upgrade from previous versions!

SmartFolio competitive edge

The standard approach still taken by most investment management and portfolio optimization software packages is essentially based on the one-period model proposed by Harry Markowitz in 1952. This model is overly simple, and while it is computationally efficient, it also suffers a number of serious drawbacks. These drawbacks are listed below with information on how SmartFolio handles each of them.

|

Conventional software |

SmartFolio |

|

Since the Markovitz model is single-period, you are not allowed to rebalance your portfolio during its lifespan. This might be OK for short-term investments, but is a serious problem for long-term investment plans. |

We have placed continuous-time portfolio theory at the heart of SmartFolio. This approach is much more realistic as it enables you to rebalance your portfolio from time to time. Using our built-in tools, you can construct portfolio strategies that not only benefit from rebalancing, but also minimize rebalancing transaction costs. |

|

The Markowitz model assumes that the parameters which define market state are known. This applies to the expected returns and volatilities of assets, as well as asset interdependencies, measured using correlations. This assumption together with the common practice of replacing these values with their sample counterparts leads to unjustifiably risky portfolios with weights concentrated in a small number of assets. As a result, in the real world, portfolios obtained in such a way often perform quite poorly. |

SmartFolio implements various techniques to handle this problem, known as parameter uncertainty. These techniques include:

|

|

Markowitz assumed that asset returns are normally distributed. Unfortunately even such “regular” assets as stocks and bonds deviate slightly from normality. This is particularly true for more complicated financial instruments such as derivatives or hedge funds. |

Along with standard analytical methods that utilize normal distribution of returns, SmartFolio includes tools that enable you to test and optimize your portfolios directly on historical data. “Normal model” approach is by far more computationally efficient and stable, while the “historical simulation” approach gives you more realistic results especially when performing risk analysis using Value-at-Risk. Thus, combining these two methods allows you to achieve the best result. |

|

Portfolio selection in the Markovitz model is based on the Risk-Reward criterion: first you define an acceptable level of portfolio variance, and then you find the portfolio that maximizes return for the given level of risk. The problem with this approach is that variance is highly inadequate as a measure of risk; even when a portfolio’s returns satisfy the “normal distribution” condition, its financial sense remains obscure for the investor. An alternative approach that exploits utility functions suffers from another weakness; an investor’s risk-aversion coefficient, which defines his utility function, is very difficult, if even possible, to estimate. |

Along with the standard utility-based approach, SmartFolio incorporates another technique of determining your investment goal. This is based on the assumption that what you care most about when selecting your portfolio is the probability that your portfolio beats the target growth rate. Rates and probabilities are well-defined and very intuitive notions; therefore there is a much lower chance that you will not be satisfied with your investments just because your goals were estimated incorrectly. |

📚 Why Choose the SmartFolio 3.2.4 Individual License – SmartFolio - Giá gốc là: $599.00.$39.00Giá hiện tại là: $39.00. Course?

The SmartFolio 3.2.4 Individual License – SmartFolio - Giá gốc là: $599.00.$39.00Giá hiện tại là: $39.00. course is more than just an online program—it's a transformative learning experience designed to help you reach new heights. Here's why learners from around the world trust WSOLib:

- ✅ Comprehensive and easy-to-follow course content.

- ✅ Practical techniques that you can apply immediately.

- ✅ Lifetime access to all course materials.

- ✅ Learn at your own pace, from anywhere in the world.

- ✅ No hidden fees—one-time payment with full access.

💻 What’s Included in the SmartFolio 3.2.4 Individual License – SmartFolio - Giá gốc là: $599.00.$39.00Giá hiện tại là: $39.00. Course?

This course comes with:

- 🎥 High-quality video lessons that guide you step-by-step.

- 📄 Downloadable resources and course materials.

- 🧩 Interactive exercises to enhance your learning experience.

- 📧 Access to customer support for any assistance you need.

🚀 Ready to Get Started?

Don’t miss out on the opportunity to unlock your potential with the SmartFolio 3.2.4 Individual License – SmartFolio - Giá gốc là: $599.00.$39.00Giá hiện tại là: $39.00. course. Start learning today and take the first step toward a brighter future. At WSOLib, we are committed to providing you with the best online learning experience.

If you have any questions, feel free to contact us. We’re here to support your learning journey every step of the way!

Specification: SmartFolio 3.2.4 Individual License – SmartFolio

|

User Reviews

Only logged in customers who have purchased this product may leave a review.

Giá gốc là: $599.00.$39.00Giá hiện tại là: $39.00.

There are no reviews yet.