Stewart Patton – Tax Savvy US Expat Entrepreneur

Giá gốc là: $800.00.$84.00Giá hiện tại là: $84.00.

🎓 Learn and Grow with Stewart Patton – Tax Savvy US Expat Entrepreneur - Giá gốc là: $800.00.$84.00Giá hiện tại là: $84.00.

Unlock your potential with the Stewart Patton – Tax Savvy US Expat Entrepreneur - Giá gốc là: $800.00.$84.00Giá hiện tại là: $84.00. course. Designed for learners of all levels, this comprehensive online program offers you the tools and strategies to achieve success in both your personal and professional life. At WSOLib, we provide top-quality learning resources, making it easy for you to enhance your skills from the comfort of your own home.

Whether you're looking to advance your career, improve your knowledge, or explore a new hobby, the Stewart Patton – Tax Savvy US Expat Entrepreneur - Giá gốc là: $800.00.$84.00Giá hiện tại là: $84.00. course is your gateway to valuable insights and practical applications. Start your learning journey today and experience the benefits of lifelong education!

Salepage link: At HERE. Archive:

Stewart Patton – Tax Savvy US Expat Entrepreneur

Entrepreneur: Complete tax and legal structuring solution for location-independent entrepreneurs

Living outside the US creates an awesome opportunity to own and operate your own location-independent business and pay no or very little tax. But actually understanding and implementing this opportunity can be difficult.

Get Stewart Patton – Tax Savvy US Expat Entrepreneur at the CourseAvai

The Jungle Gets Thicker

Once you start putting together your own location-independent business as an expat or digital nomad, the complications intensify.

Now you have all sorts of issues to figure out:

- Can I operate my business through a non-US corporation?

- If so, what’s the best jurisdiction in which to form my non-US corporation?

- How do I set up a non-US corporation without getting scammed?

- Can I still bank in the US?

- How can I open a US bank account under a non-US corporation?

- What are the exact US tax consequences of using this structure?

- How exactly do I operate a business under a legal entity?

- How can I invest for retirement ?

- How do I report all this on my US tax return?

- Will I still have to pay state tax?

- And what about non-US tax?

The Paths get More Treachorous

Let’s look at different ways to answer these questions.

The IRS provides absolutely no help at all. IRS Publication 54 doesn’t discuss which legal structures are best in particular situations, and of course the IRS can’t tell you how to form a non-US corporation. The IRS is just silent on all these issues.

Then, the internet is full of unreliable yammering about these issues. The nuggets of good advice are buried under so many layers of supposition and contradiction that it would take you hours and hours to find the gold. You’ll be so fed up at that point that you wouldn’t recognize it.

Also, the crocodiles are thicker and meaner in this part of the jungle. All sorts of “offshore gurus” and fly-by-night incorporation services are looking to sell you a useless and over-complicated structure at an exorbitant rate.

Now, of course I have a package of services for location-independent entrepreneurs where I take care of everything for you. But I’m extremely busy and I get new inquiries all the time, so I charge several thousand dollars per year. Unfortunately, my services aren’t really accessible to many bootstrapped startups and early-stage lifestyle businesses.

A Better Way

That’s why I created the Tax-Savvy Expat Entrepreneur course.

My first online course, Tax-Savvy Expat Essentials, shows you how the tax rules create the opportunity to own a location-independent business and pay no or very little tax. Now, Entrepreneur shows you exactly how to take full advantage of this opportunity.

Beyond just discussing the tax rules, Entrepreneur also provides:

- a step-by-step guide to actually creating the proper legal structure for your situation,

- direct links to the people and resources you need to form your legal structure, and

- the actual legal documents you need to get your legal structure together.

Plus, your purchase of Entrepreneur includes a one-hour consultation call. We’ll go over your particular situation and make sure you understand exactly how to move forward.

Entrepreneur is an complete actionable resource that contains everything you need to actually get your own legal structure up and running in as little time as possible.

The course contains the same information I provide my clients and the same resources and legal documents I use to get the job done.

Who this course is for

Entrepreneur is designed to help digital nomads and expat entrepreneurs who own and operate a location-independent business.

You own a “location-independent business” when (i) you sell something other than your own time (such as other people’s time, physical or digital products, advertising space, or access to software) and (ii) you aren’t tied to an on-the-ground location in any particular country.

Common examples of location-independent businesses include the following:

- affiliate marketing,

- digital agency,

- web hosting,

- niche websites,

- ad-based internet publishing businesses (such as a blog, podcast, or YouTube channel),

- SaaS and SwaS businesses,

- e-commerce businesses (such as Amazon FBA, drop-shipping), and

- traffic arbitrage.

One caveat here: the legal structure discussed in Entrepreneur does not work for businesses with a US-based founder or that operate using employees or dependent agents located in the US. However, it’s perfectly fine to use the services of a third party running their own business in the US.

Are you interested in? Seth Godin – The Marketing Seminar: Summer Session

Get Stewart Patton – Tax Savvy US Expat Entrepreneur at the CourseAvai

Here’s how it works

Entrepreneur consists of nine video lectures where I talk over professionally designed slides. The lectures total up to 1.5 hours (but you can speed up or slow down the playback if you like).

You have instant and continuous access to the whole course, so you can go back and review whenever you have a question.

Each section also has notes that provide additional detail on the subject matter of each lecture and contain links to the resources you need to organize your structure.

Finally, the actual legal documents you need are attached right in the part of the course where they’re discussed and at the end (so you have easy access to everything when you’re done).

Table of contents

Here are the nine lessons that comprise Entrepreneur:

- Course Overview

- Tax-Savvy Expat Entrepreneur Structure: Introduction

- Tax-Savvy Expat Entrepreneur Structure: Formation

- Tax-Savvy Expat Entrepreneur Structure: Operation

- US Tax Consequences: Business Income

- US Tax Consequences: Investment Income

- US Tax Reporting and Accounting

- State Tax and Non-US Tax

- Next Steps

Invest in your success

You’ve spent time and money to figure out your business and increase your revenue, right? Well, plugging tax leaks in your legal structure is even more important.

It’s not just about the money you make, it’s about the money you keep. Investing in the right legal structure pays a return year after year by legally keeping more money in your pocket.

In fact, several of my students use what they learned in Entrepreneur to easily save $25,000 or more in tax, every single year.

Entrepreneur shows you:

How to minimize US federal income tax, US self-employment tax, state tax, and non-U.S. tax;

How to determine the best legal structure for your particular situation;

How to actually create that legal structure (with an easy step-by-step guide and the actual resources and legal documents you need); and

How to operate your business under that legal structure.

In addition to everything described above, your purchase of Entrepreneur includes a one-hour consultation. We can apply what you learn in Entrepreneur to your particular situation and make sure you have all the tools you need to get your own structure together.

The legal structure you put together after taking this course will pay you year after year in legal US tax savings.

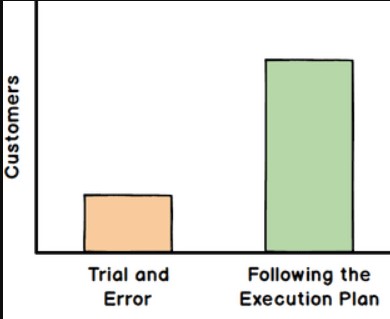

Even beyond that, Entrepreneur really pays for itself immediately. Here’s why:

- you’ll save tons of time scouring the internet and talking with experts to figure this all out on your own;

- you’ll avoid the expensive and well-marketed entity formation services-easily saving you the entire cost of this course in your first year; and

- you’ll save the lawyer fees necessary to create the legal documents included in this course.

Also, as an added bonus, your purchase of Entrepreneur gives you free access to both Essentials and Freelancer.

Get Stewart Patton – Tax Savvy US Expat Entrepreneur at the CourseAvai

Sale Page : http://ustax.bz/courses/tax-savvy-expat/entrepreneur/

Archive Sale Page: http://archive.is/COYEr

Entrepreneur: Complete tax an

📚 Why Choose the Stewart Patton – Tax Savvy US Expat Entrepreneur - Giá gốc là: $800.00.$84.00Giá hiện tại là: $84.00. Course?

The Stewart Patton – Tax Savvy US Expat Entrepreneur - Giá gốc là: $800.00.$84.00Giá hiện tại là: $84.00. course is more than just an online program—it's a transformative learning experience designed to help you reach new heights. Here's why learners from around the world trust WSOLib:

- ✅ Comprehensive and easy-to-follow course content.

- ✅ Practical techniques that you can apply immediately.

- ✅ Lifetime access to all course materials.

- ✅ Learn at your own pace, from anywhere in the world.

- ✅ No hidden fees—one-time payment with full access.

💻 What’s Included in the Stewart Patton – Tax Savvy US Expat Entrepreneur - Giá gốc là: $800.00.$84.00Giá hiện tại là: $84.00. Course?

This course comes with:

- 🎥 High-quality video lessons that guide you step-by-step.

- 📄 Downloadable resources and course materials.

- 🧩 Interactive exercises to enhance your learning experience.

- 📧 Access to customer support for any assistance you need.

🚀 Ready to Get Started?

Don’t miss out on the opportunity to unlock your potential with the Stewart Patton – Tax Savvy US Expat Entrepreneur - Giá gốc là: $800.00.$84.00Giá hiện tại là: $84.00. course. Start learning today and take the first step toward a brighter future. At WSOLib, we are committed to providing you with the best online learning experience.

If you have any questions, feel free to contact us. We’re here to support your learning journey every step of the way!

Specification: Stewart Patton – Tax Savvy US Expat Entrepreneur

|

User Reviews

Only logged in customers who have purchased this product may leave a review.

Giá gốc là: $800.00.$84.00Giá hiện tại là: $84.00.

There are no reviews yet.